Investment giant KKR & Co. Inc. agreed to buy online contact lens retailer 1-800 Contacts Inc. (No. 93 in the 2020 Digital Commerce 360 Top 1000) from previous owner AEA Investors LP.

1-800 Contacts and KKR didn’t disclose the transaction’s financial terms in a joint statement Wednesday. However, people familiar with the matter said the deal values 1-800 Contacts at more than $3.00 billion.

“They spent a lot of time investing in telemedicine solutions,” Felix Gernburd, a managing director at KKR, told Bloomberg News. “When shelter-in-place orders were restricting movement, 1-800 Contacts was one of the few places you could go to get your contacts.” The number of people using the retailer’s two online eye-exam apps at least tripled at the peak of the coronavirus-related shutdowns, the statement says.

Started in a dorm room in 1995, 1-800 Contacts sells eyewear and contact lenses online. AEA Investors acquired the merchant in 2016 from Thomas H. Lee Partners.

“We believe 1-800 Contacts’ singular focus on providing a consistent and high-quality customer experience, fueled by industry-leading capabilities and telemedicine solutions, positions them well to continue to drive innovation in the category,” Felix Gernburd, a KKR managing director, said in the joint statement.

KKR’s rationale for buying 1-800 Contacts makes a lot of sense, according to George Deeb, managing partner of consulting and venture capital firm Red Rocket Ventures. The appeal for KKR, he says, is the chance to gain a sizable, innovative business in the massive healthcare industry with telemedicine capabilities, such as the ability to offer online eye exams. The deal also shows the strength of ecommerce during the pandemic, he says.

“The transaction clearly shows that ecommerce is alive and well in a world post-COVID, as more shoppers are buying from home—not in stores,” Deeb says.

AEA Investors bought 1-800 Contacts almost five years ago, and most professional investors have a three- to seven-year time horizon. Hence, AEA most likely wanted to exit its investment to help lock in the returns, Deeb says.

This week’s acquisition is not KKR’s first foray into eye care. In 2014, KKR invested in bricks-and-mortar eyewear retailer National Vision Holdings Inc. and then took it public in 2017.

A surge of new customers during the pandemic

As Americans get used to the new reality of receiving health care products and services during the pandemic, 1-800 Contacts experienced a surge of new customers—and a need to adapt.

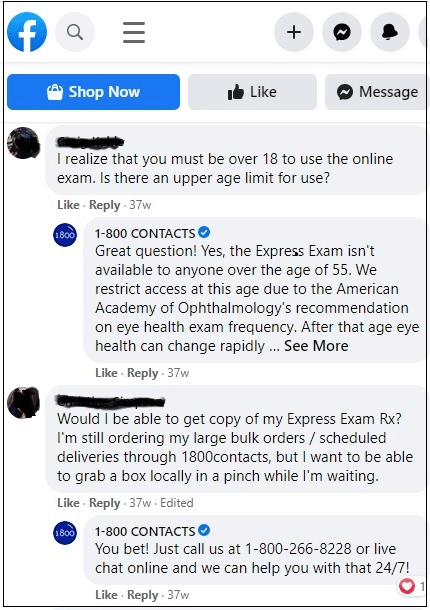

1-800 Contacts says it increased its engagement across social channels to connect with consumers posting about buying contacts or glasses online.

The retailer also experienced roughly 100% year-over-year increases in new customers and repeat customers, 1-800 Contacts says, without providing specific numbers. The retailer declined to discuss how much its sales increased during that time.

Once the pandemic-related lockdowns started, 1-800 Contacts says it increased its engagement across social channels to connect with consumers posting about buying contacts or eyeglasses online. Partially because of those efforts, the retailer saw a roughly 200% increase in the use of ExpressExam—an online vision test consumers can use to renew their prescriptions, Phil Bienert, chief marketing officer, told Digital Commerce 360 before the retailer and KKR announced the acquisition.

In some respects, 1-800 Contacts was “almost designed” for the COVID-19 crisis and the lockdowns, Bienert says. “We’ve been champions of the expansion of telemedicine for many years, both as a way to increase access to vision care and to help evolve the stagnant vision industry. We were already offering telemedicine services that allow customers to renew prescriptions online, choose from the largest selection of brands and receive their contacts right to their door quickly, which meant we already had the technology in place to be able to serve our customers when others can’t,” he says.

ExpressExam provides eligible customers with a free, 10-minute online vision exam and renewed contact lens prescriptions from board-certified eye doctors. Consumers can have the exams from smartphones or computers and often get new prescriptions within just a few hours, the retailer says. The retailer determines eligibility for telehealth services by gathering information about customers’ age, location and eye health history.

“When optometrists were forced to close their doors, we stepped up our efforts to help Americans get their prescriptions renewed and contacts replenished, especially those on the front lines,” Bienert says. “We have over 45 million contact lenses in our distribution centers and are shipping orders daily. There’s been no disruption to the supply chain, so we are well prepared to take care of customers.”

The volume of calls the retailer’s call-center staff handles per day is as much as an 85% increase over pre-pandemic projections, Bienert says. To help meet the surge in sales and customers, the retailer added 200 employees from March 16 to early September, he says. The lion’s share of the new hiring was in operations roles, but the retailer hired corporate staff as well, he says.

During peak times, as many as 50 company “volunteers,” including CEO John Graham, stepped in to help ship orders at the distribution center, Bienert says.

1-800 Contacts, founded 25 years ago, owns brands including Liingo Eyewear, 6over6, Boomerang and Premium Vision. Morgan Stanley and Jefferies Financial Group Inc. are financial advisers to the retailer on the KKR deal.

James Melton contributed to this report.